|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

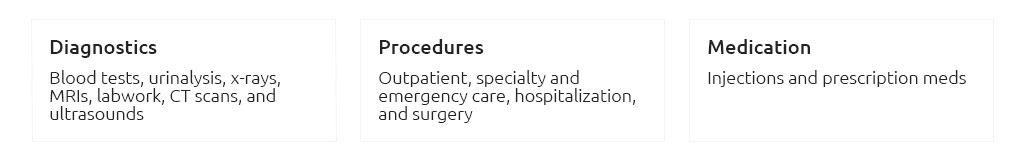

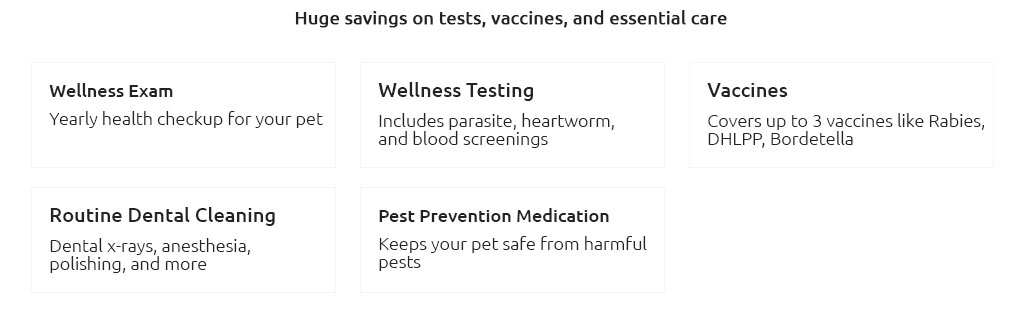

cheap pet insurance nj guide for budget-conscious pet parentsWhy prices varyIn New Jersey, premiums hinge on your pet’s age, breed, and the vet costs in your ZIP code. Insurers also price plans differently for accident-only, accident and illness, and wellness add-ons. A policy can be cheap without being flimsy if you match coverage to your real risks. What to look forCompare annual limits, reimbursement rates, and deductibles as a trio. A lower premium with a sky-high deductible may cost more after one bad week at the clinic. Ask about waiting periods, bilateral condition rules, and how they handle exam fees and Rx.

To keep it affordable, start young, skip unnecessary riders, and revisit quotes annually. If your pet has pre-existing issues, consider accident-only as a bridge while you build an emergency fund. https://www.healthypawspetinsurance.com/locations/nj/new-jersey-pet-insurance

With a Healthy Paws insurance plan, you can take your pet to any licensed veterinarian in New Jersey and across the U.S., and that includes specialists and ... https://www.fetchpet.com/locations/nj-pet-insurance

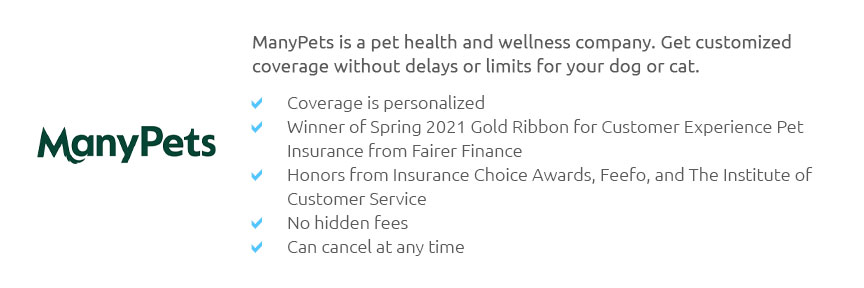

Get the best pet insurance in New Jersey for your dog or cat. Fetch offers the most comprehensive coverage in New Jersey and in all of the U.S.. https://manypets.com/us/states/new-jersey/

But New Jersey is one of the most expensive states in the country for veterinary care. The average ManyPets insurance claim in the Garden State is $451 the ...

|